Super Bowl Advertising

When you think of Super Bowl Advertising, you’ll probably think of the advertising during the game; you know the ones that cost millions of dollars per 30 seconds. The cost of purchasing advertising time during the Super Bowl has increased significantly over the years, with a 30-second commercial costing $37,500 in 1967. The average cost of a 30-second ad has reached up to $8 million in 2025 and for 2026, NBCUniversal confirmed that all commercial inventory for the Super Bowl is sold out.

The Super Bowl is the most-watched TV event in the US, and many viewers tune in primarily for the commercials, making it a unique opportunity for brands to generate significant exposure.

At Gourmet Ads we run Super Bowl Advertising that drives consumers to buy your food and beverage products even before the end-of-season game. We decided to present a few recent food advertisement examples to demonstrate the types of advertising we see in Gourmet Ads. Our Super Bowl Advertising Reaches Grocery Buyers Before the Big Game.

Each January the Super Bowl draws an enormous audience of viewers from around the country, most at super bowl parties. Running a targeted Super Bowl advertising campaign can influence grocery buyers as they plan their party spread. Because the Gourmet Ads network features an audience of grocery buyers and household decision makers, it’s essential to ensure that we are part of your Super Bowl Advertising media mix.

Key Takeaways

- A 30-second Super Bowl spot costs approximately $7-8 million in 2024-2026, with total campaign costs often exceeding $15-25 million when including production and digital amplification

- Super Bowl ads reach 115-128 million viewers, approximately one-third of the U.S. population, with audiences who actively watch and discuss commercials

- Food and beverage brands dominate because their products are consumed during the viewing experience, creating unique in-the-moment marketing synergy

- ROI is measurable. For example, Budweiser sees approximately 172% return on Super Bowl investment, with sales lifts documented across beer and soda categories

- The standard format is 30 seconds, though 60-second spots work best for cinematic, emotional, or purpose-driven storytelling

- Creative trends include nostalgia, AI themes, purpose-driven messaging, and multi-brand coordinated campaigns

Super Bowl Advertising Strategies & Targeting

From a Media Planning and Buying perspective, Gourmet Ads recommends for brands wanting to engage and influence Grocery Buyers using Contextual Targeting and Audience Segments for their Super Bowl Advertising Campaign. Some brands choose to skip the event due to the high costs, while others continue to invest heavily for the potential of significant brand exposure. Super Bowl advertisements often become some of the most memorable commercials aired, with advertisers leveraging nostalgia and social media to enhance reach and engagement. These ads frequently receive additional exposure after the game, being shared widely on social media platforms and featured in news segments. Integrating all marketing touchpoints, such as TV and social media, creates a unified brand experience during Super Bowl advertising.

What Makes Super Bowl Advertising So Unique?

Super Bowl commercials are event television in its purest form. Unlike regular commercial ads where viewers treat commercial breaks as bathroom runs or phone scrolling opportunities, the big game creates an atmosphere where advertisements become primary content. This fundamental shift in audience psychology, where commercials are entertainment rather than interruption, creates an advertising context unlike anything else in the world.

The numbers tell the story. Year after year, the Super Bowl draws well over a hundred million viewers in the U.S., consistently ranking among the most-watched broadcasts in television history. This means the ad breaks during the game are essentially the most expensive minutes in American television, reaching roughly one third of the U.S. population in a single broadcast. While most TV advertising is losing viewers because people are cutting cable, moving to streaming, and younger audiences are less engaged, the Super Bowl keeps its massive audience.

The cultural impact extends far beyond the initial broadcast. Consider these iconic spots that became part of wider pop culture:

- Apple’s “1984” (Macintosh launch): A woman hurling a sledgehammer through a dictatorial broadcast, establishing the template for Super Bowl ads as creative benchmarks

- Coca-Cola’s “Hey Kid, Catch!” featuring Joe Greene: Created the emotional formula for athlete-brand connections.

- Budweiser’s “Wassup!” (2000): Quoted and parodied for years, demonstrating how a beer commercial could enter everyday conversation

The Super Bowl functions as advertising’s biggest stage for brand storytelling: cinematic production values, A-list celebrities, original songs, and early adoption of technology trends. The 2022 game saw crypto brands deploy QR code ads, while 2025-2026 campaigns increasingly feature generative AI themes and production techniques.

Modern campaigns are built for multi-channel amplification. Ads are pre-released and extended on YouTube, TikTok, and social media to create weeks of buzz, transforming a single 30-second broadcast into a sustained marketing campaign. For categories like beer and soda, this cultural phenomenon ties the brand directly to the ritual of watching the football game, creating long-term mental associations between “football Sunday” and their product that persist year-round.

How Much Does a Super Bowl Ad Cost?

A 30-second national Super Bowl spot reached approximately $7 million in 2024 and is reported at around $7-7.5 million for Super Bowl LX on February 8, 2026, at Levi’s Stadium in Santa Clara. For the 2025 game, prices spiked to $8 million for a 30-second commercial, partly driven by scarcity when California wildfires opened up advertiser slots that FOX filled at premium rates.

The historical trajectory reveals just how dramatically this ad space has appreciated:

- 1967 (First Game): $37,500 per 30 seconds—fairly unheard of for sporting events at the time

- 1968: $75,000 per 30 seconds (already doubled)

- 1977: $125,000 per 30 seconds

- 1985: Crossed the $500,000 threshold

- Early 1990s: $1 million+

- Mid-2000s: $2-3 million

- 2019 (Super Bowl LIII): $5.2 million

- 2024-2026: $7-8 million

When adjusted for inflation, that 1967 fee of $37,500 represents significantly less purchasing power than today’s equivalent. But even accounting for inflation, the real cost has increased dramatically, a reflection of the Super Bowl’s growing cultural significance and shrinking alternatives for mass reach advertising.

The $7 million figure is just for national ad time. Brands also spend millions more on:

- Production costs (celebrity fees, CGI, director talent)

- Integrated digital campaigns

- Pre-game and post-game social media amplification

- Retail activation and in-store displays

This makes total budgets for top companies like Amazon or General Motors exceed $20 million or more per year. Amazon’s 2022 “Mind Reader” Alexa spot carried an estimated total value of around $26 million. GM and Cadillac’s 2021 celebrity-heavy EV ads each ran approximately $22 million when accounting for all production and media costs.

Some smaller players purchase cheaper local slots on regional affiliates rather than national network time, which can still reach millions in a specific market at a fraction of the national cost.

What Is the Average Super Bowl Ad Duration?

The standard Super Bowl commercial is 30 seconds, which networks like NBC, CBS, and Fox use as the basic unit for pricing. When you hear that a Super Bowl ad costs $7 million, that’s the 30-second rate.

While 30 seconds is the norm, brands deploy various formats depending on their strategy and budget:

- 15-second teasers: Quick brand reminders or sequel spots

- 30-second spots: The workhorse format for most advertisers

- 45-60 second spots: For major launches or emotional storytelling

- 90-second “mini-films”: Rare, reserved for purpose-driven campaigns or blockbuster launches

Recent examples show the range in action. He Gets Us planned a 60-second spot in the second half of Super Bowl 60, investing in longer storytelling time for their faith based messaging. Dove secured a 30-second second quarter placement in 2026. Multiple PepsiCo brands like Pepsi Zero Sugar, Poppi, and Lay’s each bought 30-second slots in the same game to create a multi-brand ecosystem effect.

Many brands produce extended 60-120 second “director’s cuts” for YouTube and social platforms but only air a 30-second edit on television due to cost constraints. This approach maximizes the TV investment by creating additional content for digital channels where length restrictions don’t apply.

Pregame and postgame ads typically cost less per unit and might use different lengths, but the headline commercials aired during the main broadcast that generate the most conversation are almost always 30 or 60 seconds.

Do Longer Super Bowl Ads Perform Better Than Short Ones?

Longer spots like 60 or 90 seconds allow more storytelling, but they also double or triple the already huge cost compared with a 30-second spot. The question isn’t simply “longer equals better”. It’s whether the additional time justifies the additional spend.

Academic and industry research suggests that ads displayed during the game and creative quality matter more than sheer length. A great 30-second ad can significantly outperform a weak 60-second one. The deciding factors are:

When Longer Ads Tend to Work Best

- Complex product launches requiring context and drama (Apple’s 1984, Cadillac’s EV reveals)

- Purpose-driven campaigns where emotional build-up matters (He Gets Us, Chrysler’s “Halftime in America”)

- Narrative driven storytelling that can’t be compressed without losing impact

- Brands that are prepared to fully leverage the longer format across social and PR channels

When 30-Second Spots Make More Sense

- Humor-driven concepts with quick payoffs

- Brand reminder campaigns where recognition matters more than story

- Brands that are buying multiple slots for frequency across different quarters

- Budget constraints that make efficiency a priority

Consider 84 Lumber’s “The Journey” from 2017. It was a 6-minute spot that only aired partially during the game, driving traffic online for the full version. This showed how a longer narrative can work when paired with digital extensions, turning a broadcast limitation into a traffic driving opportunity.

The Trade-Off Calculation

A single 60-second ad versus two 30-second spots isn’t straightforward. Two shorter spots can be placed in different quarters for more frequency and potentially better recall. However, a 60-second spot provides uninterrupted storytelling time that two 30-second spots can’t replicate.

Hence, the longer Super Bowl ads tend to perform best when they are cinematic, emotional, or purpose-driven and when the brand can fully leverage them across social, PR, and digital channels. Otherwise, most advertisers stick to efficient 30-second units.

Why Food and Beverage Brands Love Advertising in the Super Bowl

Food and beverage advertisers like beer, soda, snacks, condiments, hydration drinks, and candy brands have dominated Super Bowl ad lineups for decades. This isn’t a coincidence. The category alignment with the event is nearly perfect.

The game day consumption context creates unique marketing synergy. Millions of viewers gather around TVs with beer, soft drinks, wings, chips, dips, and treats. Advertising snacks and drinks during the game is directly tied to in-the-moment purchase. This psychological alignment between advertisement and concurrent consumption makes the marketing message immediately actionable.

Anheuser Busch company holds the most valuable deal in the Super Bowl ecosystem: pouring rights at all 32 NFL team stadiums valued at $230 million per year. This dominance extends far beyond television advertising, embedding the brand throughout the entire Super Bowl experience.

- Immediate sales spikes: Chips, soda, and beer bought for the game itself create a same day purchase impact

- Retail leverage: Super Bowl ads help brands secure display space and partnerships with retailers like Walmart, Kroger, and Instacart. These ads become proof points in trade marketing discussions before the game

- Long-term brand building: Research shows beer and soda brands see measurable sales lifts after campaigns, with effects extending beyond game day

- Cultural association: Being tied to “the biggest night in sports” creates year-round mental availability

New beverage trends use the Super Bowl to signal mainstream arrival. Better-for-you sodas like Poppi, hard seltzers, and functional hydration drinks like Liquid I.V. invest in big game spots to prove they’ve “made it” alongside legacy brands like Budweiser and Pepsi. For challenger brands in the beverage market, Super Bowl presence serves as a credibility signal to retailers, investors, and consumers alike.

Types of Food and Beverage Brands Advertising in the Super Bowl

The diversity within food and beverage Super Bowl advertising reflects the breadth of what fans consume on game day. Here’s how the category breaks down:

Mass-market beer brands like Budweiser and Bud Light have built decades of Clydesdales and humorous campaigns. Anheuser Busch’s long-running exclusive national beer category deal shaped the advertising landscape for years, making the Super Bowl synonymous with beer advertising. In 2024, Budweiser executed a campaign with Oscar-winning director Chloé Zhao, employing recovery and redemption themes. It showed the production sophistication of these brands.

Soft drinks and soda brands like Pepsi and Coca Cola have battled across Super Bowl broadcasts for generations. PepsiCo now runs multiple soda and snack spots in a single game to create an “ecosystem” of ads. Pepsi Zero Sugar functional sodas like Poppi demonstrate the company’s multi-brand strategy. This approach maximizes their overall presence without relying on a single commercial to carry the entire burden.

Salty snacks and party foods like Pringles, Lay’s, and Ritz with football-shaped crackers link directly to the big game snack table. Hellmann’s mayonnaise campaigns leverage recipes and dip culture, connecting their condiment brand to the food rituals fans already practice. These brands understand that their products are literally on the table during viewing.

Hydration and wellness drinks like Liquid I.V.’s 2026 debut focus on “real hydration,” positioning functional beverages as a game-day essential. Liquid Death’s bold canned water branding offers a rebellious alternative to soda and alcohol, using edgy creative to stand out in a category historically dominated by conventional beverage marketing. These wellness-focused brands are reframing what people drink during the game.

For 2026 debut, SVEDKA Vodka features a Fembot and AI-driven dancing robots, while Sazerac made moves into the big game. These brands navigate NFL rules around hard liquor and responsible drinking messaging carefully, knowing the visibility comes with scrutiny.

Confectionery and sweet snacks are also very famous. Nerds’ campaigns with influencers like Addison Rae and Shaboozey continue the long tradition of candy brands using humor to stand out between serious automotive and tech ads. Sweet treats offer a different emotional register that contrasts effectively with the earnest storytelling of other categories.

Creative Trends Seen in Recent Super Bowl Campaigns

Super Bowl 2024-2026 campaigns show strong thematic patterns: nostalgia, generative AI, purpose-driven messages, and multi-brand storytelling dominate the creative landscape.

Ads referencing 1980s and 1990s culture appeal to Gen X and Millennial viewers who now have purchasing power and game-day hosting responsibilities. Hellmann’s nod to “When Harry Met Sally,” remakes of classic spots, and 1980s-style music and visual aesthetics tap into collective memory. These callbacks worked and increased sales because they create instant emotional recognition.

Generative AI and Robots

SVEDKA’s Fembot and AI “magic” represent broader 2025-2026 expectations for AI-themed creative. Beyond just themes, AI-assisted production of ad concepts is becoming more common, with brands exploring how the technology can enhance their creative development process. Expect more commercials addressing AI’s role in life directly.

Celebrities and Crossovers

High-profile celebrity appearances remain a core Super Bowl tactic. Antonio Banderas in Bosch’s 2025 ad, Issa Rae in TurboTax 2025, and various sports stars and musical artists in PepsiCo and snack campaigns demonstrate that star power cuts through the noise. Celebrities provide instant recognition and often bring their own fan bases to amplify the ad’s reach.

Purpose and Social Messages

Dove’s body confidence campaigns for young girls, He Gets Us’s faith-based spots about connection, and historically issue-tinged ads like Chrysler’s “Halftime in America” show how brands use the Super Bowl to attach themselves to values and causes. The biggest night in television becomes a platform for stating what a brand stands for and not just what it sells.

In recent years, PepsiCo, Unilever, and other brands have used coordinated campaigns in a single game to dominate mindshare and shelf space. Rather than isolated spots, these become integrated marketing systems where each ad reinforces the others.

Interactive and Second-Screen Experiences

Coinbase’s QR code ad during the 2022 Crypto Bowl crashed their servers when millions scanned simultaneously. SVEDKA’s 2026 spot incorporated social media dance-submission mechanics. Modern ads are built for live engagement and post-game sharing on streaming platforms and social media, extending the life and reach of the creative investment.

How Advertisers Measure the Success of Super Bowl Campaigns

Measuring success goes beyond TV ratings. Brands now track a mix of brand metrics, sales impact, and digital engagement to determine whether their investment paid off.

Brand Lift and Awareness

Pre-game and post-game surveys measure recall (“Which ads do you remember?”), brand favorability, and purchase intent. Third-party rankings like USA Today’s Ad Meter and Kantar or Nielsen brand-effect studies provide benchmarked comparisons. These measurements help companies understand whether their creative broke through the clutter.

Sales and Short-Term ROI

Stanford research indicates that beer and soda brands experience measurable household sales lifts after Super Bowl ads. Budweiser’s campaigns have been estimated to deliver tens of millions in incremental revenue and approximately 172% ROI. For CPG brands, this sales lift can be tracked through scanner data within days of the broadcast.

Digital and Social Metrics

Modern measurement includes:

- YouTube views and watch time

- TikTok remixes and engagement

- X (Twitter) mentions and sentiment analysis

- Hashtag performance across platforms

- Website or app traffic spikes

Coinbase’s QR ad in 2022 crashed their servers, which was a dramatic example of measurable digital response. 84 Lumber’s site overload after “The Journey” showed how broadcast creative drives online behavior.

Longer-Term Equity Effects

A string of consecutive Super Bowl appearances contributes to consistent brand positioning and top-of-mind associations:

- TurboTax: 13 consecutive years

- WeatherTech: 14th appearance

- Dove: 3-year streak

- Hellmann’s: 6-year run

This consistency builds mental availability that pays dividends beyond any single campaign.

Retail and Trade Outcomes

CPG and beverage brands also measure incremental display placements at retailers, co-op marketing with Instacart and grocery chains, and whether Super Bowl activation improves their shelf and search visibility. The ad becomes a negotiating tool in trade marketing conversations months before and after the broadcast.

Are Super Bowl Ads Really Worth the Investment

With $7 million for 30 seconds plus production costs, a single Super Bowl appearance can run $10-20 million or more. This makes the ROI question critical for any marketing leader considering the investment.

The Case for Super Bowl Advertising

- Stanford research shows Super Bowl ads boost beer and soda sales when competitors don’t also advertise heavily

- Budweiser sees roughly a 15-16% short-term sales increase per household from its Super Bowl association

- For mass-market food and beverage brands, the combination of immediate sales lift and long-term brand building often justifies the cost

Competitive Dynamics Matter

When two similar brands like Coke and Pepsi, or rival beer companies, both advertise heavily, they can erode each other’s gains, reducing net impact. But this creates a prisoner’s dilemma: neither wants to be absent while their competition dominates the conversation. This makes non-participation risky for established leaders.

The Defensive Value

For legacy brands like Budweiser, Pepsi, Coca Cola, and major snacks, skipping the game could hand cultural relevance and shelf dominance to competitors. Part of the ROI calculation is “not losing ground” while maintaining the position you’ve built through years of consistent presence.

Newer Brands Face Different Challenges

Debuts by Liquid I.V., Liquid Death, SVEDKA, Manscaped, and Grubhub represent big bets to accelerate awareness quickly. For these players, the payoff often depends on sustained marketing and strong follow-up, not a single ad alone. A Super Bowl spot can put a brand on the map, but keeping it there requires continued investment.

When Super Bowl Ads Fail

Some expensive spots flop creatively, spark backlash, or fail to justify cost. Nationwide’s 2015 “Boy” ad generated intense negative reaction. Just For Feet’s “Kenyan Mission” became a cautionary tale in advertising history. Political or controversial issue ads often generate attention that doesn’t translate to brand benefit.

The Verdict

Super Bowl advertising tends to be most “worth it” for:

- Large, mass-market brands with broad appeal

- Categories tightly tied to game-day rituals (food and beverages especially)

- Companies that are prepared to amplify the spot across digital, social, and retail channels

- Brands where maintaining competitive parity matters as much as gaining advantage

Planning a Super Bowl Campaign: Strategy, Creative, and Media

For brands considering Super Bowl LX on February 8, 2026, at Levi’s Stadium in Santa Clara, planning should start now. Fox sold out its advertising inventory earlier than ever, with digital ad investment edging up 20% which signals continued demand despite record pricing.

Media Strategy Decisions

Brands must choose between first half versus second half placements strategically:

- He Gets Us opted for a second-half 60-second national ad, betting on sustained viewer attention

- Liquid Death and Liquid I.V. chose first-half slots to catch peak viewership

- Companies buying multiple 30-second units can spread them across quarters for frequency

The third quarter often sees slight viewership dips, while the second quarter typically maintains strong attention. The lead up to halftime and the fourth quarter during close games command premium attention. It must be decided a few months in advance at what time the brands want to play their ad.

Creative Brief Essentials

Strong Super Bowl briefs must clarify:

- Role of celebrities (starring versus cameo versus none)

- Tone: humor versus emotional

- Product focus versus brand story emphasis

- Connection to broader cultural trends (AI, nostalgia, social causes)

- How the 30-second broadcast version relates to longer YouTube cuts

Category Timing Alignment

TurboTax’s 13-year streak of timely Super Bowl ads aligns perfectly with tax season, making the game a natural moment to reach consumers already thinking about filing. Dove’s and Novartis’s health-oriented messaging windows show how brands can connect the Super Bowl moment to seasonal consumer needs. The first time many viewers see these ads, they’re already in the right mindset.

Risk and Reputation Management

High visibility brings high scrutiny. The history of controversial ads, rejected spots from Ashley Madison, PETA’s boundary-pushing creative, and politically divisive messages serves as a reminder that the biggest night in advertising can also create the biggest problems. Modern campaigns require careful legal, ethical, and cultural review before air.

For marketers at companies considering their first place in Super Bowl advertising, the planning window extends 12-18 months out. Waiting until the season starts means sold-out inventory and limited options.

Whether you’re a legacy brand defending market position or a new entrant looking to break through, the Super Bowl remains the ultimate test of whether a brand can capture America’s attention. The $7 million question isn’t whether Super Bowl commercials work, but it’s whether your brand and your creative are ready to compete on advertising’s biggest stage.

Summary

The Super Bowl is the most powerful advertising platform in the U.S., attracting more than 100 million viewers each year and making commercial breaks as anticipated as the game itself. With a 30-second slot now costing about $7–8 million and full campaign budgets often topping $15–25 million, brands invest heavily because the audience watches ads actively rather than skipping them. Food and beverage companies dominate because their products are consumed during the event, creating immediate sales impact as well as long term brand lift. Beer, soda, snacks, and emerging wellness brands repeatedly see measurable ROI, including sales spikes and sustained awareness.

Super Bowl advertising has evolved into a cultural phenomenon. Iconic commercials from brands like Apple, Coca-Cola, and Budweiser show how ads can shape pop culture and become talking points far beyond the broadcast. Creative trends include nostalgia, celebrity cameos, purpose-driven messaging, and newer themes like AI integration. Modern campaigns extend across social media, streaming, and retail partnerships to maximize the investment.

Measurement now includes sales increases, brand lift surveys, social engagement, and retail activation. While expensive and not without risk, most leading national brands view the Super Bowl as essential for visibility, competitiveness, and maintaining cultural relevance.

Super Bowl Contextual Targeting

- Super Bowl Recipes

- Party Recipes

- Chicken Wing Recipes

- Snack Recipes

- Chicken Wing Recipes

- Burger Recipes

- Nacho Recipes

- Chili Recipes

- Guacamole Recipes

- Salsa Recipes

- Dip Recipes

- Pizza Recipes

- Pasta Recipes

Super Bowl Audience Segments

These segments can be used uncoupled in your own DSP

- Chicken Segment

- Grocery Buyers Segment

- Household Cooks Segment

- Recipe Content Segment

- Cocktail Content Segment

Super Bowl Campaign Options

- Programmatic Advertising via Deal ID / PMP

- Curated Deals

- Managed Services

Super Bowl Dates

- Super Bowl LX 2026

8th Feb 2026 in Levi’s Stadium in Santa Clara, California - Super Bowl LXI 2027

14th February 2027 in SoFi Stadium in Inglewood, California - Super Bowl LXII 2028

February 2028, at Mercedes-Benz Stadium in Atlanta, Georgia.

Super Bowl Ads

Here are some of the Super Bowl Ads we’ve run across Gourmet Ads.

Meijer – 300×600

Tyson – 300×600

Pringles – 300×600

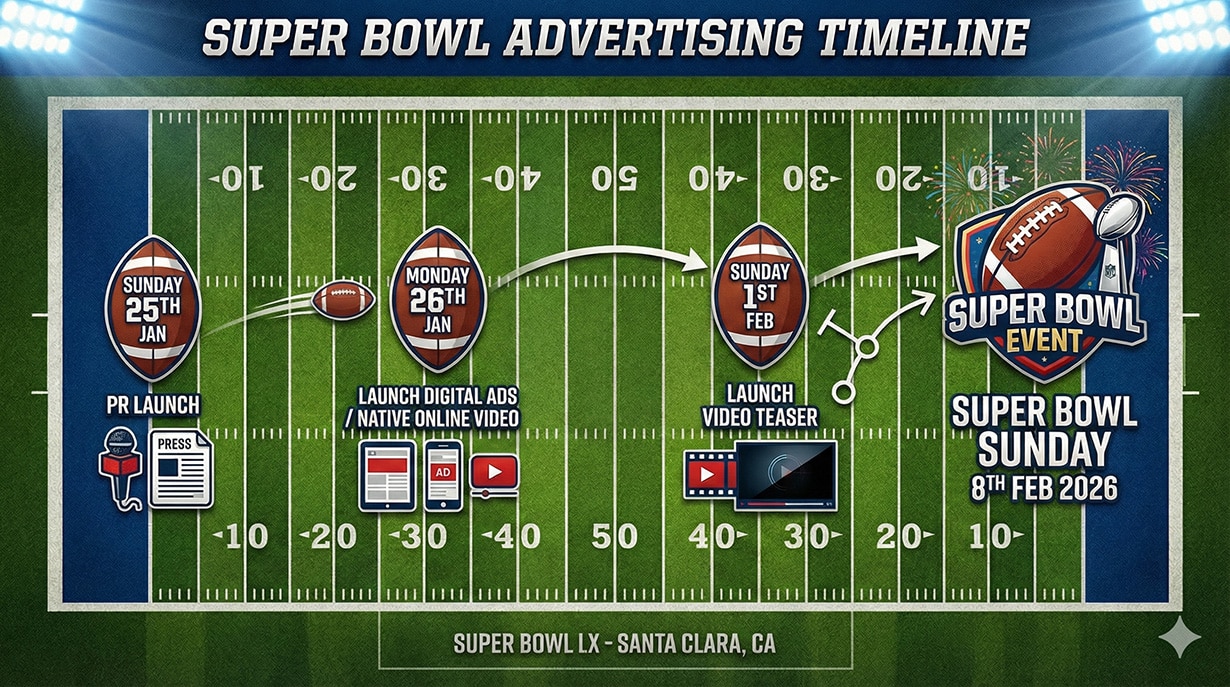

The Super Bowl Advertising Timeline

Based on tracking of historical Super Bowl search data and other consumer behaviors, here’s a primer for planning your brand’s Super Bowl Advertising campaign.

The Super Bowl airs the first or second Sunday in February, which means your Super Bowl Advertising should commence in the last week of January, giving a two-week campaign flight to drive consumer intent and engagement. Popular campaign ideas include using regular display advertising, video and rich media. Each of these placement types can support high-performing campaigns including competitions and Super Bowl coupon downloads for product purchases.

First-time Super Bowl advertisers can see up to a 36% increase in brand awareness following their commercials, and Super Bowl ads can result in a 22% increase in total word-of-mouth marketing the week following the game

So what companies can benefit from Super Bowl Advertising online? Any company that has products being served at Super Bowl Parties. Heavy finger food dishes including ingredients found in dips, guacamole, chili, bbq ribs, nachos, hot wings, sliders, hamburgers, hot dogs and quesadillas are extremely popular among grocery buyers this time of year. Don’t forget chips, popcorn, crackers, cheese as well as beverages such as sodas, wines and beer, all of which traditionally are traditionally found in the million dollar TV advertising.

Production and Creation of Super Bowl Ads

The production and creation of Super Bowl commercials is a high-stakes endeavor that commands the attention of the entire advertising industry. With the Super Bowl recognized as advertising’s biggest stage, brands pull out all the stops to ensure their ads stand out during the biggest night in advertising.

Creating a Super Bowl ad is a collaborative process that often begins months before the big game. Brands work closely with advertising agencies, production companies, and sometimes their own in-house teams to develop concepts that will resonate with the massive audience.

Innovation is key to making an impact. Many brands leverage star power to headline their super bowl campaign, while others use cutting-edge technology to create immersive, memorable experiences. Whether it’s a first-time Super Bowl ad or a return to the big game, the production process is marked by creativity, strategic planning, and a commitment to delivering commercials that capture the spirit of the Super Bowl and leave a lasting impression on millions of viewers.